Summary – “Retention of Accounting Records: A Global Survey of Laws and Regulations”

This article summarizes a report published by AIEF on June 3, 2019. Additionally, the article is included in Information Management Magazine, ARMA-AIEF Special Edition, which will be available for download in mid-November. A printed version of the special issue will be available as well, for a nominal fee.

This article summarizes the findings of a global survey of legal retention requirements for accounting records, a category of recorded information that is created and maintained by virtually all companies, government agencies, and non-profit organizations. The survey, which was sponsored by the ARMA International Educational Foundation (AIEF), covers 192 sovereign nations as well as eight dependent territories with recordkeeping laws and regulations that differ from those of their controlling countries. The survey is intended for records managers, compliance officers, information governance specialists, attorneys, risk managers, financial officers, and others who need to know how long accounting records must be kept to comply with legal and regulatory requirements in specific countries. The full survey, which cites applicable laws and regulations for each country and dependent territory, can be downloaded from the AIEF website.

Legal Framework

Globally, more than 1,000 laws and regulations specify requirements or have significant implications for retention of records related to an organization’s accounting transactions and financial condition. In any given country, however, retention of accounting records is covered by three to six laws and regulations in the following categories:

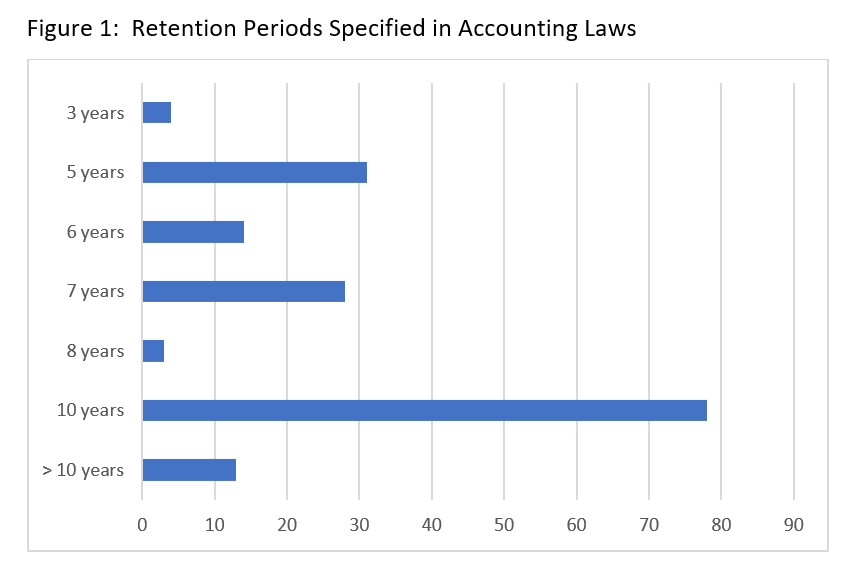

- Accounting Law: 171 of the 200 countries and dependent territories have accounting laws or regulations that specify minimum retention periods for financial records maintained by organizations that operate within their borders. (Most of the remaining countries and dependent territories have accounting laws that require organizations to maintain adequate financial records, but those laws do not specify retention periods.) In some countries, an accounting act or bookkeeping act specifies retention requirements for accounting ledgers, financial statements, fiscal audit reports, and supporting documentation, including inventory records, accounts payable and receivable records, and correspondence related to accounting transactions. More commonly, retention of accounting records is addressed in a commercial code, which regulates the activities of commercial enterprises, or a company law, which specifies recordkeeping requirements to protect the interests of shareholders, partners, or other stakeholders. In many countries, national accounting laws apply to for-profit companies, but they provide a useful retention benchmark for educational institutions, cultural organizations, charities, and other non-profit entities that operate in a given country or dependent territory. As summarized in Figure 1, retention periods specified in accounting laws and regulations range from 3 years to more than 10 years. The retention period typically begins at the end of the fiscal or calendar year to which the records pertain.

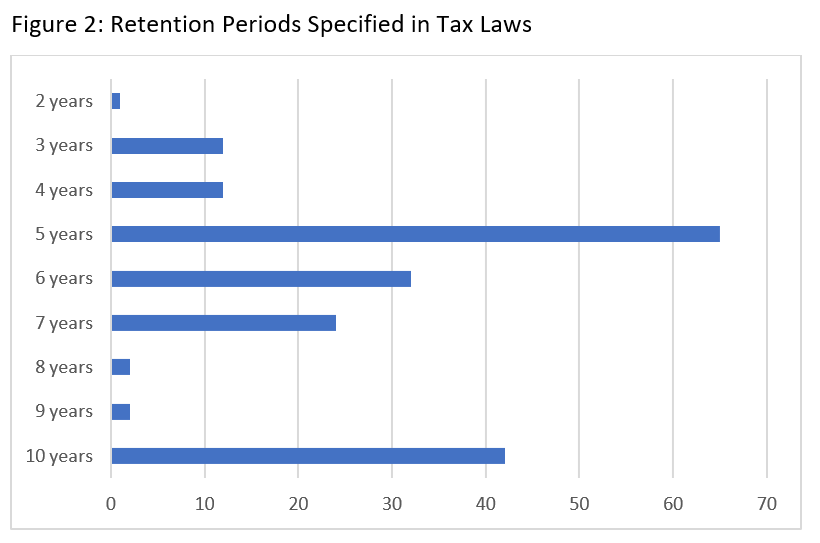

- Tax law: 197 of the 200 countries and dependent territories have laws or regulations that mandate retention of accounting records that are relevant for assessment of income taxes. (The three exceptions do not have an income tax.) In some cases, minimum retention periods for accounting records are specified in an income tax code or in regulations that interpret or clarify the tax code. Alternatively, the income tax code or income tax regulations may state that accounting records must be retained until the limitation period for tax assessment has elapsed. In a few countries, the income tax code defers to retention requirements specified in an accounting law. As summarized in Figure 2, retention periods specified in tax laws range from 2 years to 10 years. The retention period may begin at the end of the tax year to which the records pertain or the date that a tax return was due or submitted. Retention periods based on the statute of limitations for tax assessment typically range from 3 to 6 years, but a longer limitation period may apply if a fraudulent return is suspected.

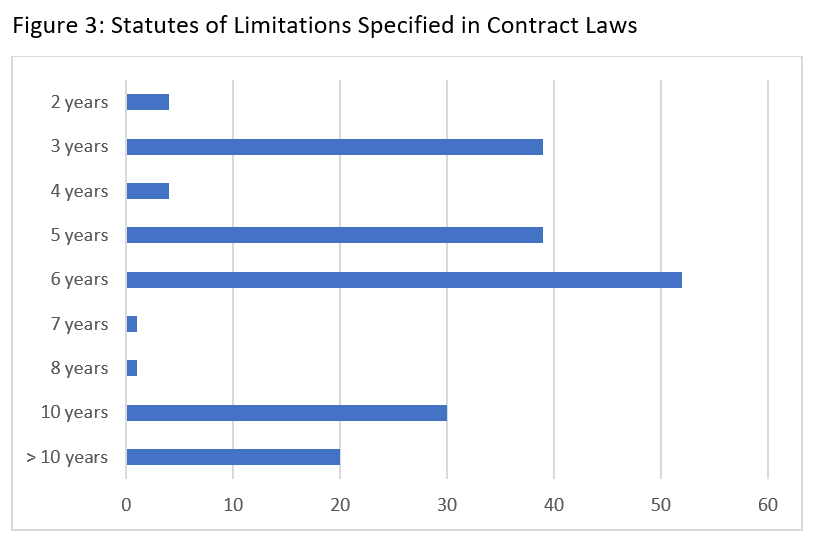

- Contract law: Accounting records may be relevant for contract claims and other legal disputes related to financial matters. In 194 of the 200 countries and dependent territories, a national civil code, national commercial code, limitation act, or other law specifies time limits – so-called statutes of limitation or periods of prescription – for initiation of civil litigation. Organizations are not obligated to retain accounting records until applicable limitation periods elapse, but it is widely considered prudent to do so. As summarized in Figure 3, limitation periods specified in contract laws range from 2 years to more than 10 years. The limitation period typically begins when a contract breach or other cause of action occurs.

Compliance-oriented retention decisions are based on the longest retention period specified in applicable laws and regulations. Generally, accounting laws are the retention drivers. Minimum retention periods specified in accounting laws are longer than those specified in tax laws in 163 of the 171 countries and dependent territories with an accounting law that specifies retention requirements. Overall, contract laws are the least important resource for retention decisions. The minimum retention periods specified in accounting laws and tax laws exceed the statute of limitations for contract-related litigation in 177 of the 200 countries and dependent territories. Even in countries and dependent territories with long limitation periods, contract laws do not have the same legal significance as retention periods mandated by accounting laws and tax laws because there is no legal requirement to retain accounting records until applicable statute of limitations elapse unless litigation is pending or imminent.

Location and Format Requirements

Recordkeeping requirements specified in laws and regulations are not limited to retention periods. More than 100 countries have laws and regulations that mandate retention of accounting records at an organization’s principal business location or another location in the country. This is done to ensure the availability of accounting records for tax audits and, in the case of corporations and partnerships, inspection of the records by shareholders and government regulators. Even where in-country retention is not mandated, various laws and regulations require in-country retention of sufficient accounting records to accurately indicate an organization’s financial position for a specified period – the most recent quarter, 6 months, or fiscal year, for example. In some countries and dependent territories, tax officials must approve out-of-country retention or in-country storage locations apart from an organization’s registered office.

Acknowledging the longstanding computerization of accounting operations, most countries permit the retention of accounting records in electronic form provided they are accessible throughout their retention periods. This provision may be included in an accounting law, a tax law, or an electronic transaction or electronic signature law. In this context, accessible means readable and usable. Some laws also require that the integrity of electronic records be protected and that printed copies be made available for reference upon request.

Developing Global Guidance

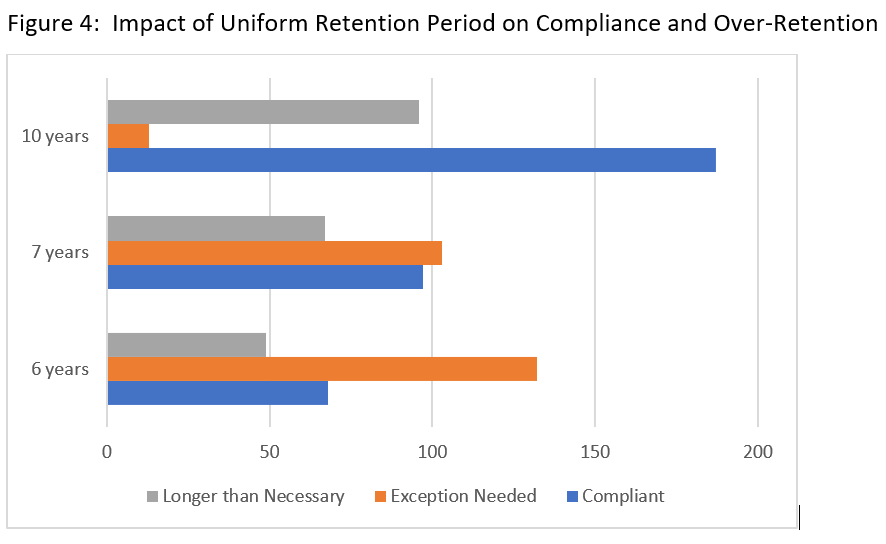

Compliance with national requirements for retention of accounting records is a significant concern for multi-national organizations, which are headquartered in one country but have branches or subsidiaries in other countries, and transnational organizations, which have distinct, autonomous operations in multiple countries. As an alternative to separately developed retention periods for accounting records in each jurisdiction, a multi-national and transnational organization may want to provide uniform, enterprise-wide retention guidance for accounting records in every country or dependent territory where it operates. That approach establishes a baseline retention period that complies with minimum legal and regulatory requirements in most of the applicable countries and dependent territories. Exceptions will be limited to jurisdictions that require longer retention. The baseline retention period must be long enough to encompass as many countries and dependent territories as possible, but some over-retention is unavoidable; the fewer the exceptions, the greater the number of countries and dependent territories where accounting records will be kept longer than necessary to comply with laws and regulations.

As previously depicted in Figure 1, 10 years is the most commonly encountered retention requirement by a wide margin in national accounting laws. Only 13 countries have accounting laws or tax laws that require longer retention of accounting records, but a 10-year baseline retention period exceeds the minimum retention requirement for accounting records in 96 countries and dependent territories. As Figure 4 indicates, a shorter baseline retention period – 6 years or 7 years – will reduce over-retention, but it will increase the number of exceptions that must be made for countries and dependent territories with longer retention requirements.

Operational Considerations

The AIEF survey was intentionally limited to legal and regulatory requirements, but retention decisions for accounting records must also consider operational needs. Accounting ledgers and journals are the basis for balance sheets, income statements, and other reports that depict an organization’s financial position. They will be consulted when questions, issues, or concerns arise about specific accounting transactions. Accounting ledgers and journals are routinely reviewed during financial audits to assess an organization’s practices and internal controls; to verify the organization’s financial statements; to confirm that transactions, assets, and liabilities are properly recorded; and to identify deficiencies or violations that require management attention and corrective action. Accounting ledgers and journals are also used for management planning and decision-making related to an organization’s financial performance, to monitor revenue and expenditures, and to prepare budgets for future years. While it is legally compliant, a 6-year, 7-year, or 10-year retention period may not be long enough for these operational purposes.

The full report is available at http://armaedfoundation.org/research-program_menu/research-reports/

Copyright 2019 ARMA International / AIEF

View the PDF version of this article.

[ls_content_block id=”683″]

[ls_content_block id=”712″]

[ls_content_block id=”734″]

[ls_content_block id=”752″]

About the Author

- William Saffady, Ph.D., FAI, is a New York-City-based information governance (IG) and information management (IM) consultant, providing analytical services and training to corporations, government agencies, not-for-profit entities, cultural institutions, and other organizations. A prolific researcher and writer, the former long-time professor at Long Island University is the author of more than three dozen books and myriad articles on a variety of IG and IM topics; his most recent books published by ARMA International are U.S. Record Retention Requirements: A Guide to 100 Commonly Encountered Record Series and Information Governance Concepts, Requirements, Technologies. Saffady can be contacted at wsaffady@aol.com.